Business Entity Types

The legal structure you choose for your business is one of the most important decisions you will make in the startup process. Your choice of structure can greatly affect the way you run your business, impacting everything from liability and taxes, to control over the company. The key is to figure out which type of entity gives your business the most advantages when it comes to helping you to achieve your organizational and personal financial goals.

Common types of business structures and corporations include C corporations, limited liability companies (LLC), partnerships, S corporations, and sole proprietorships. Learn more about each type of business or corporation:

Limited Liability Companies (LLCs)

- Independent legal structures separate from their owners.

- Help separate your personal assets from your business debts.

- Taxed similarly to a sole proprietorship (if one owner) or a partnership (if multiple owners).

- No limit to the number of owners.

- Not required to hold annual meetings or record minutes.

- Governed by operating agreements.

Simply put, it’s the least complex business structure. Unlike an s corp or c corp, an LLC’s structure is flexible. It also gives you the perk of pass-through taxes, limited liability (obviously), and legal protection for your personal assets. Plus the added benefit of looking more legit than the other guys.

Advantages of an LLC

There are several advantages to starting an LLC, but here are a few that stand out.

- Pass-through taxes. There’s no need to file a corporate tax return. Owners report their share of profit and loss on their individual tax returns, meaning you avoid double taxation.

- No residency requirement. Owners need not be U.S. citizens or permanent residents.

- Legal protection. Owners have limited liability for business debts and obligations.

- Enhanced credibility. Partners, suppliers, and lenders may look more favorably on your business when you’ve formed an LLC.

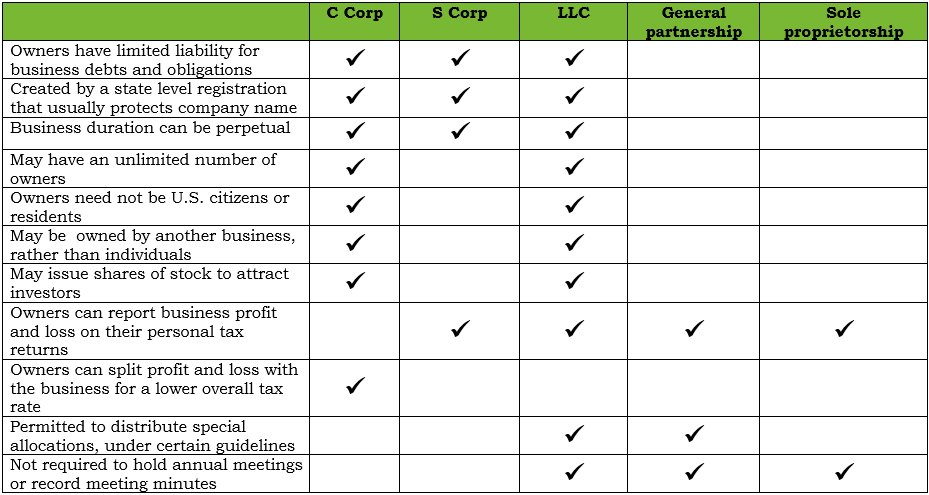

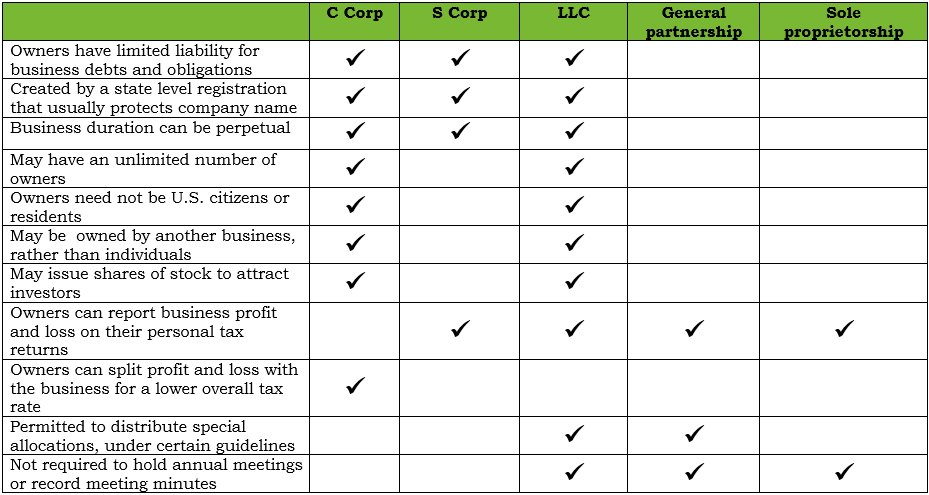

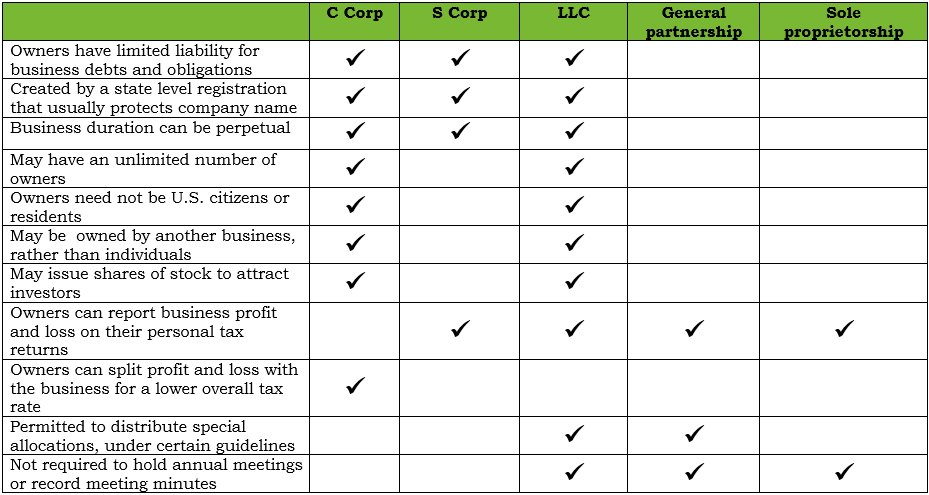

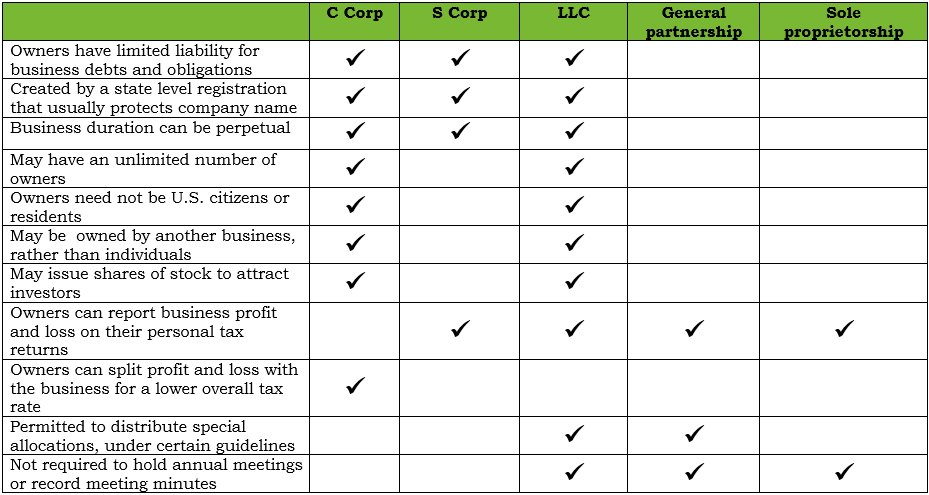

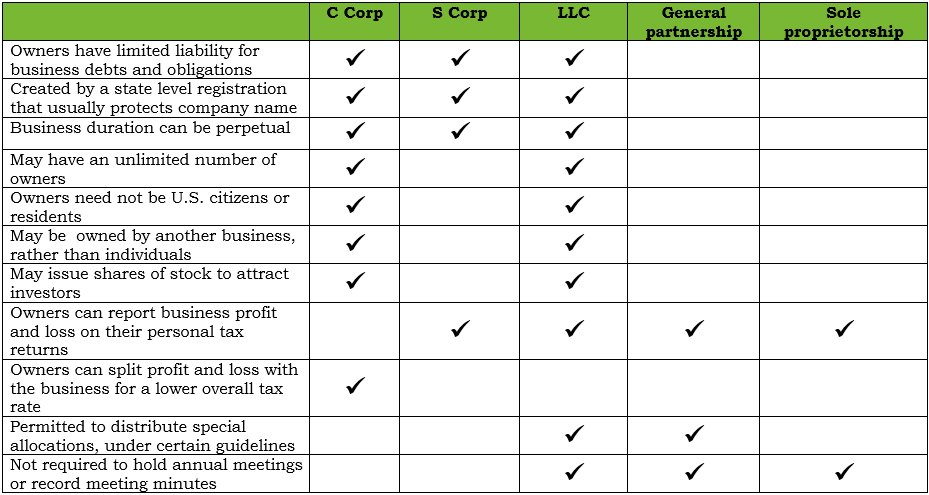

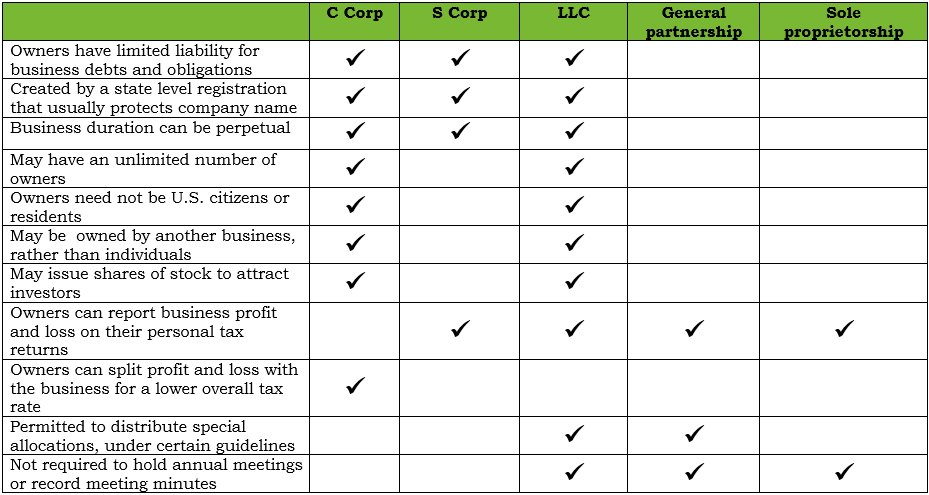

- Compare LLCs and corporations:

Disadvantages of an LLC

Creating an LLC is an attractive option, but there are a few hurdles.

- Limited growth potential. You cannot issue shares of stock to attract investors.

- Lack of uniformity. LLCs can be treated differently in different states.

- Self-employment tax. Earnings can be subject to this kind of taxation.

- Tax recognition on appreciated assets. This could happen if you convert an existing business to an LLC. One more way that extra taxation can occur.

Is Creating an LLC Right for Me?

That really depends on what your short-term and long-term business goals are. We recommend that you put some thought into where your business is now and how you want your business to grow before deciding whether the LLC structure is right for you.

How to Form an LLC (Limited Liability Company):

- Choose a legal name and reserve it, if the Secretary of State in your state does that sort of thing (not all do).

- Draft and file your Articles of Incorporation with your Secretary of State.

- Decide who will run the business (managers or members)

- Decide how many owners are in the business

- Apply for a business license and other certificates specific to your industry.

- File Form SS-4 or apply online at the Internal Revenue Service website to obtain an Employer Identification Number (EIN).

- Apply for any other ID numbers required by state and local government agencies. Requirements vary from one jurisdiction to another, but generally your business most likely will be required to pay unemployment, disability, and other payroll taxes – you will need tax ID numbers for those accounts in addition to your EIN.

C Corporations

- Independent legal and tax structures separate from their owners.

- Help separate your personal assets from your business debts.

- No limit to the number of shareholders.

- Taxed on corporate profits and shareholder dividends.

- Must hold annual meetings and record meeting minutes.

It’s the most common type of corporation in the U.S. – and with good reason. C corporations (c corps) offer unlimited growth potential through the sale of stocks, which means you can attract some very wealthy investors. Plus, there is no limit to the number of shareholders a c corp can have.

Advantages of a C Corporation

There are many benefits of a c corp. Below are just a few that stand out.

- Limited liability. This applies to directors, officers, shareholders, and employees.

- Perpetual existence. Even if the owner leaves the company.

- Enhanced credibility. Gain respect among suppliers and lenders.

- Unlimited growth potential. The sky’s the limit thanks to the sale of stock.

- No shareholders limit. However, once the company has $10 million in assets and 500 shareholders, it is required to register with the SEC under the Securities Exchange Act of 1934.

- Certain tax advantages. Enjoy tax-deductible business expenses.

Disadvantages of a C Corporation

Having unlimited growth comes with a few minor setbacks.

- Double taxation. It’s inevitable as revenue is taxed at the company level and again as shareholder dividends.

- Expensive to start. There are a lot of fees that come with filing the Articles of Incorporation. And corporations pay fees to the state in which they operate.

- Regulations and formalities. C corps experience more government oversight than other companies due to complex tax rules and the protection provided to owners from being responsible for debts, lawsuits, and other financial obligations.

- No deduction of corporate losses. Unlike an s corporation (s corp), shareholders can’t deduct losses on their personal tax returns.

C Corporation vs. S Corporation

Both c and s corps offer limited liability protection. Both require Articles of Incorporation to be filed. And both comprise shareholders, directors, and officers. There are lots of similarities, but they differ in the complex realm of taxation and corporate ownership.

As we mentioned above, c corps are subject to double taxation while s corps are pass-through tax entities, allowing them to avoid being taxed at the corporate level and again on shareholders’ personal income taxes.

When it comes to corporate ownership, c corps have no restriction on ownership, which goes back to our point about them having unlimited growth potential. But s corps don’t have that luxury as they’re restricted to no more than 100 shareholders. Also, s corps cannot be owned by a c corp, other s corps, LLCs, partnerships, or many trusts. But a c corp has no limits on who or what can be a shareholder. Compare corporations and LLCs with our business comparison chart.

How to Form a C Corporation

- Choose a legal name and reserve it, if the Secretary of State in your state does that sort of thing (not all do).

- Draft and file your Articles of Incorporation with your Secretary of State.

- Issue stock certificates to the initial shareholders.

- Apply for a business license and other certificates specific to your industry.

- File Form SS-4 or apply online at the Internal Revenue Service website to obtain an Employer Identification Number (EIN).

- Apply for any other ID numbers required by state and local government agencies. Requirements vary from one jurisdiction to another, but generally your business most likely will be required to pay unemployment, disability, and other payroll taxes – you will need tax ID numbers for those accounts in addition to your EIN.

S Corporations

- Independent legal and tax structures separate from their owners.

- Help separate your personal assets from your business debts.

- Owners report their share of profit and loss in the company on their personal tax returns.

- Limits on number of shareholders, who must be U.S. citizens or residents.

- Must hold annual meetings and record meeting minutes.

It’s kind of like the lite version of a c corporation (c corp). An s corp offers investment opportunities, perpetual existence, and that coveted protection of limited liability. But, unlike a c corp, s corps only have to file taxes yearly and they are not subject to double taxation. Read on if this sounds enticing for your business.

S Corp Advantages

Read ’em and weep.

- Limited liability. Company directors, officers, shareholders, and employees enjoy limited liability protection.

- Pass-through taxation. Owners report their share of profit and loss on their individual tax returns.

- Elimination of double taxation of income. Income is not taxed twice – once as corporate income and again as dividend income.

- Investment opportunities. The company can attract investors through the sale of shares of stock.

- Perpetual existence. The business continues to exist even if the owner leaves or dies.

- Once-a-year tax filing requirement. Versus c corps, which must file quarterly.

S Corp Disadvantages

There’s a lot to love, but here’s a few things to consider before adding the ‘s’ to your corp.

- S. citizens and permanent residents only. Unlike the c corp and LLC (Limited Liability Company), you have to be a legal resident of the U.S.

- Limited ownership. An s corp may not have more than 100 shareholders.

- Formation and ongoing expenses. It is necessary to first incorporate the business by filing Articles of Incorporation with your desired state of incorporation, obtain a registered agent for your company, and pay the appropriate fees. Many states also impose ongoing fees, such as annual report and/or franchise tax fees.

- Tax qualification obligations. Mistakes regarding the various filing requirements can accidentally result in the termination of s corp status.

- Closer IRS scrutiny. Payments to employees and shareholders could be distributed as either salaries or dividends. Each are taxed differently, which is what leads the IRS to scrutinize that distribution more closely.

S Corporation vs. C Corporation

What is an s corp?

As we described above, an s corp is something like the lite version of a c corp. That is, when you consider its growth potential and organizational structure.

Every business that files for corporation is first classified as a c corp. Once that’s complete, you have to then file for subchapter s corp status and meet all requirements for an s corp – namely, have fewer than 100 shareholders who are all individuals, not corporations; have only one class of stock; and be owned by U.S. citizens or resident aliens. All of which are pretty easy requirements for most small businesses.

Back to the perk of saving money. An s corp is not subject to double taxation as a c corp is. That means that an s corp’s revenue is not taxed at the corporate level. It’s only taxed when paid out as salaries or dividends to shareholders. That alone could save an s corp hundreds of thousands of dollars. For this reason, a c corp makes very little sense for a small business. But if you opt for an s corp, make sure you have a solid accountant as one mistake in filing can send your company back to c corp status, leaving it open to be taxed twice.

How to Start and Form an S Corp

- Choose a legal name and reserve it, if the Secretary of State in your state does that sort of thing (not all do).

- Draft and file your Articles of Incorporation with your Secretary of State.

- Issue stock certificates to the initial shareholders.

- Apply for a business license and other certificates specific to your industry.

- File Form SS-4 or apply online at the Internal Revenue Service website to obtain an Employer Identification Number (EIN).

- Apply for any other ID numbers required by state and local government agencies. Requirements vary from one jurisdiction to another, but generally your business most likely will be required to pay unemployment, disability, and other payroll taxes – you will need tax ID numbers for those accounts in addition to your EIN.

- File the IRS form 2553 within 75 days of your corporation formation.

Partnerships

- Partners remain personally liable for lawsuits filed against the business.

- Usually no state filing required to form a partnership.

- Easy to form and operate.

- Owners report their share of profit and loss in the company on their personal tax returns.

A limited partnership (LP) is much like a general partnership, but with a few significant differences.

Management of a limited partnership rests with the “general partner,” who also bears unlimited liability for the company’s debt and obligations. A limited partnership allows for any number of “limited partners,” whose liability is limited to the total amount of their investment in the company.

Limited partners are sometimes referred to as “silent partners” – in other words, they can make investments in the company but have no voting power or control over its day-to-day operations. They can be a valuable source of capital in this business structure.

Limited partnership is the entity of choice for many law, accounting and finance firms. It’s also a popular among businesses that focus on time-restricted projects, such as real estate and film production companies.

Advantages of a limited partnership include:

- Personal asset protection: The limited partnership structure offers liability protection up to the amount of the investment for the company’s limited partners.

- Pass-through taxation. A limited partnership’s income is not taxed at the business level; instead, business profit and loss are “passed through” to the partners for reporting on their personal tax returns.

- Full oversight: The general partner has complete management control of the limited partnership.

- Investment potential: Limited partnerships can generate capital investments by adding more limited partners.

It is important to note that certain issues must be addressed in the formation of an LP that can affect the limited liability provided by the LP, such as the role of the limited partners and the effect of the death, bankruptcy or insolvency of the GP or LP on the continued existence of the LP.

Sole Proprietorships

- Owner remains personally liable for lawsuits filed against the business.

- No state filing required to form a sole proprietorship.

- Easy to form and operate.

- Owner reports business profit and loss on their personal tax return.

Review Business Comparison Chart for more details.

Regardless of business structure you choose remedy tax services can help you incorporate or form an LLC less than the cost of using an attorney.

- Owner remains personally liable for lawsuits filed against the business.

- No state filing required to form a sole proprietorship.

- Easy to form and operate.

- Owner reports business profit and loss on their personal tax return.

- Limited Liability Companies (LLCs)

-

Limited Liability Companies (LLCs)

- Independent legal structures separate from their owners.

- Help separate your personal assets from your business debts.

- Taxed similarly to a sole proprietorship (if one owner) or a partnership (if multiple owners).

- No limit to the number of owners.

- Not required to hold annual meetings or record minutes.

- Governed by operating agreements.

Simply put, it’s the least complex business structure. Unlike an s corp or c corp, an LLC’s structure is flexible. It also gives you the perk of pass-through taxes, limited liability (obviously), and legal protection for your personal assets. Plus the added benefit of looking more legit than the other guys.Advantages of an LLC

There are several advantages to starting an LLC, but here are a few that stand out.

- Pass-through taxes. There’s no need to file a corporate tax return. Owners report their share of profit and loss on their individual tax returns, meaning you avoid double taxation.

- No residency requirement. Owners need not be U.S. citizens or permanent residents.

- Legal protection. Owners have limited liability for business debts and obligations.

- Enhanced credibility. Partners, suppliers, and lenders may look more favorably on your business when you’ve formed an LLC.

- Compare LLCs and corporations:

Disadvantages of an LLC

Creating an LLC is an attractive option, but there are a few hurdles.

- Limited growth potential. You cannot issue shares of stock to attract investors.

- Lack of uniformity. LLCs can be treated differently in different states.

- Self-employment tax. Earnings can be subject to this kind of taxation.

- Tax recognition on appreciated assets. This could happen if you convert an existing business to an LLC. One more way that extra taxation can occur.

Is Creating an LLC Right for Me?

That really depends on what your short-term and long-term business goals are. We recommend that you put some thought into where your business is now and how you want your business to grow before deciding whether the LLC structure is right for you.

How to Form an LLC (Limited Liability Company):

- Choose a legal name and reserve it, if the Secretary of State in your state does that sort of thing (not all do).

- Draft and file your Articles of Incorporation with your Secretary of State.

- Decide who will run the business (managers or members)

- Decide how many owners are in the business

- Apply for a business license and other certificates specific to your industry.

- File Form SS-4 or apply online at the Internal Revenue Service website to obtain an Employer Identification Number (EIN).

- Apply for any other ID numbers required by state and local government agencies. Requirements vary from one jurisdiction to another, but generally your business most likely will be required to pay unemployment, disability, and other payroll taxes – you will need tax ID numbers for those accounts in addition to your EIN.

- C Corporations

-

C Corporations

- Independent legal and tax structures separate from their owners.

- Help separate your personal assets from your business debts.

- No limit to the number of shareholders.

- Taxed on corporate profits and shareholder dividends.

- Must hold annual meetings and record meeting minutes.

It’s the most common type of corporation in the U.S. – and with good reason. C corporations (c corps) offer unlimited growth potential through the sale of stocks, which means you can attract some very wealthy investors. Plus, there is no limit to the number of shareholders a c corp can have.

Advantages of a C Corporation

There are many benefits of a c corp. Below are just a few that stand out.

- Limited liability. This applies to directors, officers, shareholders, and employees.

- Perpetual existence. Even if the owner leaves the company.

- Enhanced credibility. Gain respect among suppliers and lenders.

- Unlimited growth potential. The sky’s the limit thanks to the sale of stock.

- No shareholders limit. However, once the company has $10 million in assets and 500 shareholders, it is required to register with the SEC under the Securities Exchange Act of 1934.

- Certain tax advantages. Enjoy tax-deductible business expenses.

Disadvantages of a C Corporation

Having unlimited growth comes with a few minor setbacks.

- Double taxation. It’s inevitable as revenue is taxed at the company level and again as shareholder dividends.

- Expensive to start. There are a lot of fees that come with filing the Articles of Incorporation. And corporations pay fees to the state in which they operate.

- Regulations and formalities. C corps experience more government oversight than other companies due to complex tax rules and the protection provided to owners from being responsible for debts, lawsuits, and other financial obligations.

- No deduction of corporate losses. Unlike an s corporation (s corp), shareholders can’t deduct losses on their personal tax returns.

C Corporation vs. S Corporation

Both c and s corps offer limited liability protection. Both require Articles of Incorporation to be filed. And both comprise shareholders, directors, and officers. There are lots of similarities, but they differ in the complex realm of taxation and corporate ownership.

As we mentioned above, c corps are subject to double taxation while s corps are pass-through tax entities, allowing them to avoid being taxed at the corporate level and again on shareholders’ personal income taxes.

When it comes to corporate ownership, c corps have no restriction on ownership, which goes back to our point about them having unlimited growth potential. But s corps don’t have that luxury as they’re restricted to no more than 100 shareholders. Also, s corps cannot be owned by a c corp, other s corps, LLCs, partnerships, or many trusts. But a c corp has no limits on who or what can be a shareholder. Compare corporations and LLCs with our business comparison chart.

How to Form a C Corporation

- Choose a legal name and reserve it, if the Secretary of State in your state does that sort of thing (not all do).

- Draft and file your Articles of Incorporation with your Secretary of State.

- Issue stock certificates to the initial shareholders.

- Apply for a business license and other certificates specific to your industry.

- File Form SS-4 or apply online at the Internal Revenue Service website to obtain an Employer Identification Number (EIN).

- Apply for any other ID numbers required by state and local government agencies. Requirements vary from one jurisdiction to another, but generally your business most likely will be required to pay unemployment, disability, and other payroll taxes – you will need tax ID numbers for those accounts in addition to your EIN.

- S Corporations

-

S Corporations

- Independent legal and tax structures separate from their owners.

- Help separate your personal assets from your business debts.

- Owners report their share of profit and loss in the company on their personal tax returns.

- Limits on number of shareholders, who must be U.S. citizens or residents.

- Must hold annual meetings and record meeting minutes.

It’s kind of like the lite version of a c corporation (c corp). An s corp offers investment opportunities, perpetual existence, and that coveted protection of limited liability. But, unlike a c corp, s corps only have to file taxes yearly and they are not subject to double taxation. Read on if this sounds enticing for your business.

S Corp Advantages

Read ’em and weep.

- Limited liability. Company directors, officers, shareholders, and employees enjoy limited liability protection.

- Pass-through taxation. Owners report their share of profit and loss on their individual tax returns.

- Elimination of double taxation of income. Income is not taxed twice – once as corporate income and again as dividend income.

- Investment opportunities. The company can attract investors through the sale of shares of stock.

- Perpetual existence. The business continues to exist even if the owner leaves or dies.

- Once-a-year tax filing requirement. Versus c corps, which must file quarterly.

S Corp Disadvantages

There’s a lot to love, but here’s a few things to consider before adding the ‘s’ to your corp.

- S. citizens and permanent residents only. Unlike the c corp and LLC (Limited Liability Company), you have to be a legal resident of the U.S.

- Limited ownership. An s corp may not have more than 100 shareholders.

- Formation and ongoing expenses. It is necessary to first incorporate the business by filing Articles of Incorporation with your desired state of incorporation, obtain a registered agent for your company, and pay the appropriate fees. Many states also impose ongoing fees, such as annual report and/or franchise tax fees.

- Tax qualification obligations. Mistakes regarding the various filing requirements can accidentally result in the termination of s corp status.

- Closer IRS scrutiny. Payments to employees and shareholders could be distributed as either salaries or dividends. Each are taxed differently, which is what leads the IRS to scrutinize that distribution more closely.

S Corporation vs. C Corporation

What is an s corp?

As we described above, an s corp is something like the lite version of a c corp. That is, when you consider its growth potential and organizational structure.

Every business that files for corporation is first classified as a c corp. Once that’s complete, you have to then file for subchapter s corp status and meet all requirements for an s corp – namely, have fewer than 100 shareholders who are all individuals, not corporations; have only one class of stock; and be owned by U.S. citizens or resident aliens. All of which are pretty easy requirements for most small businesses.

Back to the perk of saving money. An s corp is not subject to double taxation as a c corp is. That means that an s corp’s revenue is not taxed at the corporate level. It’s only taxed when paid out as salaries or dividends to shareholders. That alone could save an s corp hundreds of thousands of dollars. For this reason, a c corp makes very little sense for a small business. But if you opt for an s corp, make sure you have a solid accountant as one mistake in filing can send your company back to c corp status, leaving it open to be taxed twice.

How to Start and Form an S Corp

- Choose a legal name and reserve it, if the Secretary of State in your state does that sort of thing (not all do).

- Draft and file your Articles of Incorporation with your Secretary of State.

- Issue stock certificates to the initial shareholders.

- Apply for a business license and other certificates specific to your industry.

- File Form SS-4 or apply online at the Internal Revenue Service website to obtain an Employer Identification Number (EIN).

- Apply for any other ID numbers required by state and local government agencies. Requirements vary from one jurisdiction to another, but generally your business most likely will be required to pay unemployment, disability, and other payroll taxes – you will need tax ID numbers for those accounts in addition to your EIN.

- File the IRS form 2553 within 75 days of your corporation formation.

- Partnerships

-

Partnerships

- Partners remain personally liable for lawsuits filed against the business.

- Usually no state filing required to form a partnership.

- Easy to form and operate.

- Owners report their share of profit and loss in the company on their personal tax returns.

A limited partnership (LP) is much like a general partnership, but with a few significant differences.

Management of a limited partnership rests with the “general partner,” who also bears unlimited liability for the company’s debt and obligations. A limited partnership allows for any number of “limited partners,” whose liability is limited to the total amount of their investment in the company.

Limited partners are sometimes referred to as “silent partners” – in other words, they can make investments in the company but have no voting power or control over its day-to-day operations. They can be a valuable source of capital in this business structure.

Limited partnership is the entity of choice for many law, accounting and finance firms. It’s also a popular among businesses that focus on time-restricted projects, such as real estate and film production companies.

Advantages of a limited partnership include:

- Personal asset protection: The limited partnership structure offers liability protection up to the amount of the investment for the company’s limited partners.

- Pass-through taxation. A limited partnership’s income is not taxed at the business level; instead, business profit and loss are “passed through” to the partners for reporting on their personal tax returns.

- Full oversight: The general partner has complete management control of the limited partnership.

- Investment potential: Limited partnerships can generate capital investments by adding more limited partners.

It is important to note that certain issues must be addressed in the formation of an LP that can affect the limited liability provided by the LP, such as the role of the limited partners and the effect of the death, bankruptcy or insolvency of the GP or LP on the continued existence of the LP.

- Sole Proprietorships

-

Sole Proprietorships

- Owner remains personally liable for lawsuits filed against the business.

- No state filing required to form a sole proprietorship.

- Easy to form and operate.

- Owner reports business profit and loss on their personal tax return.

Review Business Comparison Chart for more details.

Regardless of business structure you choose remedy tax services can help you incorporate or form an LLC less than the cost of using an attorney.

- Owner remains personally liable for lawsuits filed against the business.

- No state filing required to form a sole proprietorship.

- Easy to form and operate.

- Owner reports business profit and loss on their personal tax return.